Free Budget Templates for Small Business Owners

Download and customize free budget templates from TrulySmall and stop worry about overspending!

Free Budget Templates

Want an easier tool for Budgeting?

Want a tool for invoicing and accounting?

Check out TrulySmall™ Accounting.

Keep an eye on your numbers

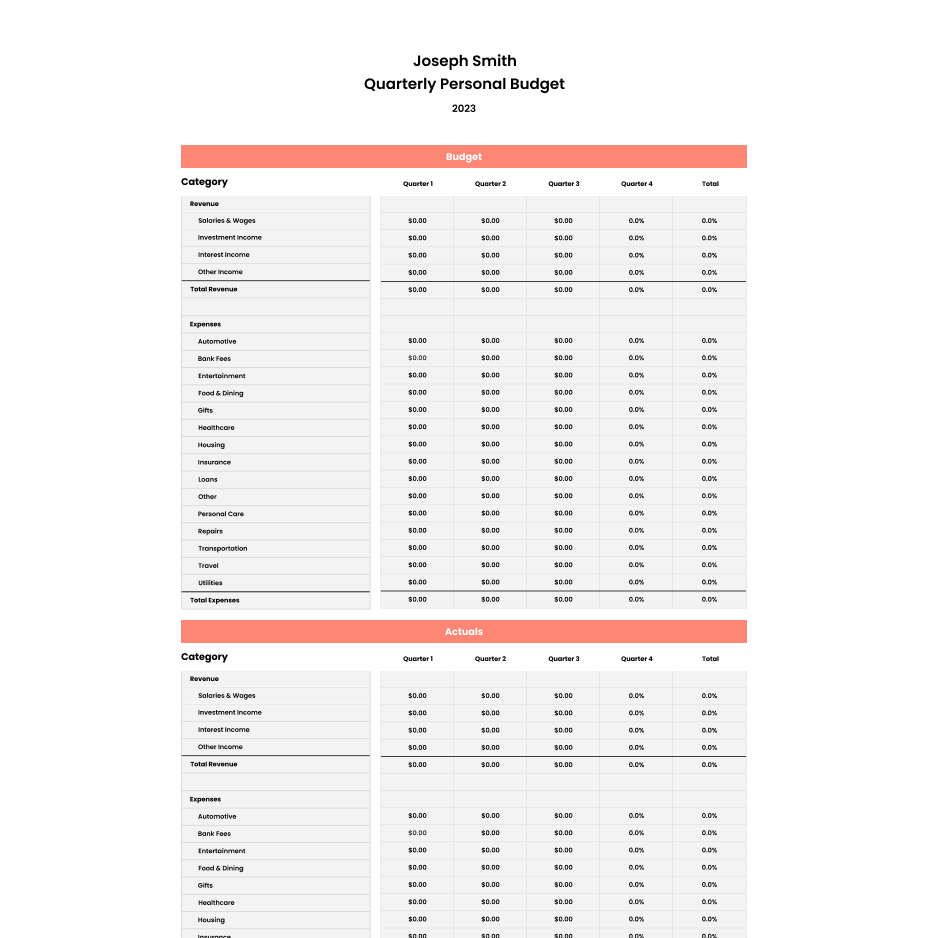

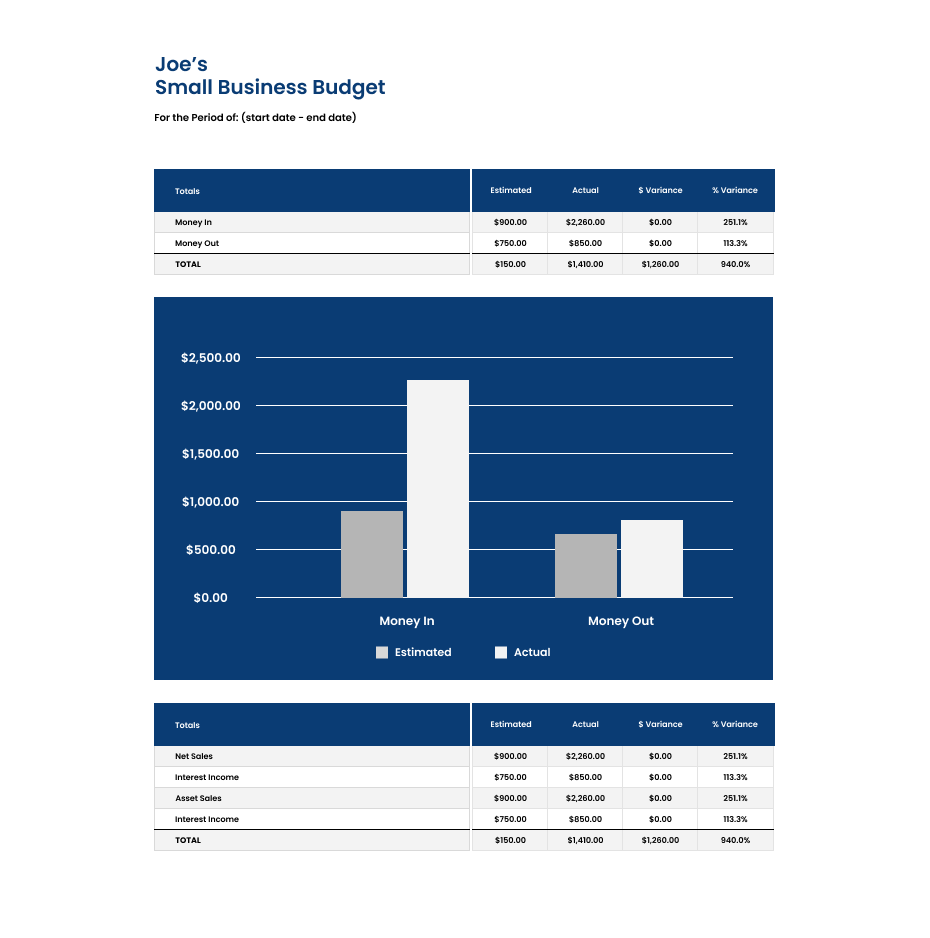

Our free simple and professional budget templates use categories to help you see what’s coming in and going out each month. Keeping track of your income and expenses has never been easier.

In these budget templates you’ll often find:

- Monthly Budget tab

- Annual Budget tab

- A spot to upload a logo

- Income tracking

- Expense tracking

What is a budget?

A budget is a spending plan for your business based on your income and expenses. It allows you to track your your available capital, estimate your spending, and helps you predict cash flow and revenue. Want to master small business budget planning? Check out our step-by-step guide.

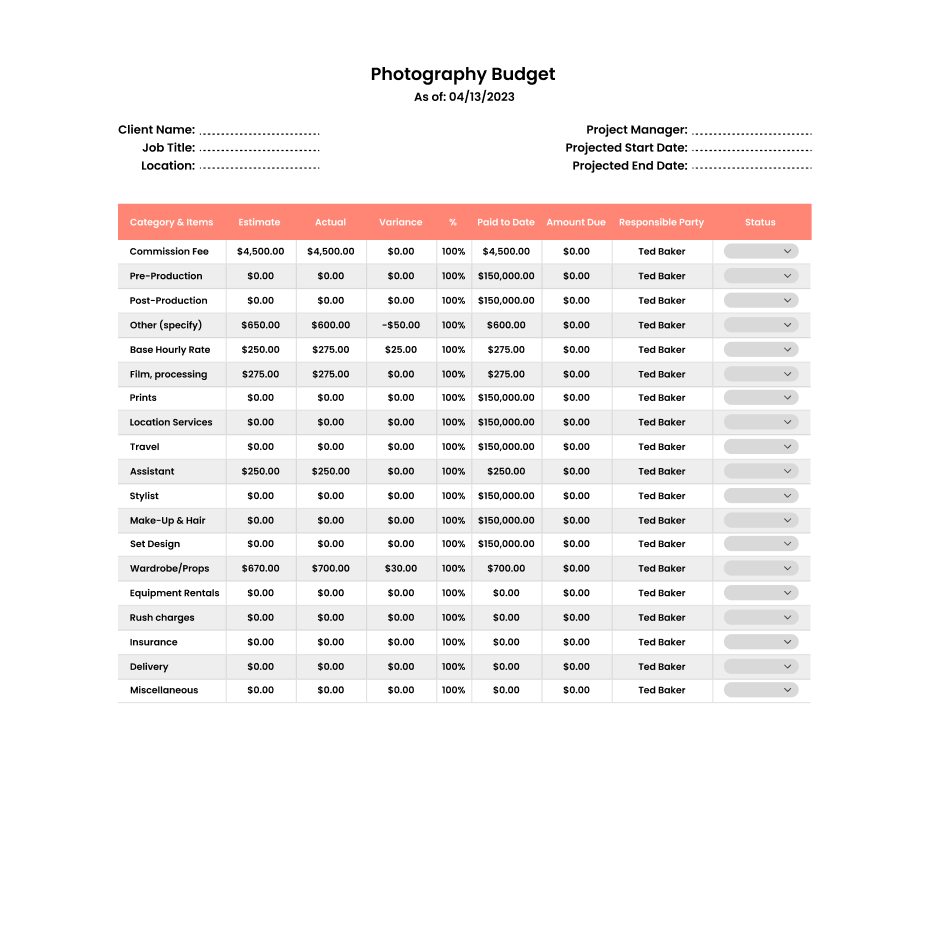

The Anatomy of a Budget Template

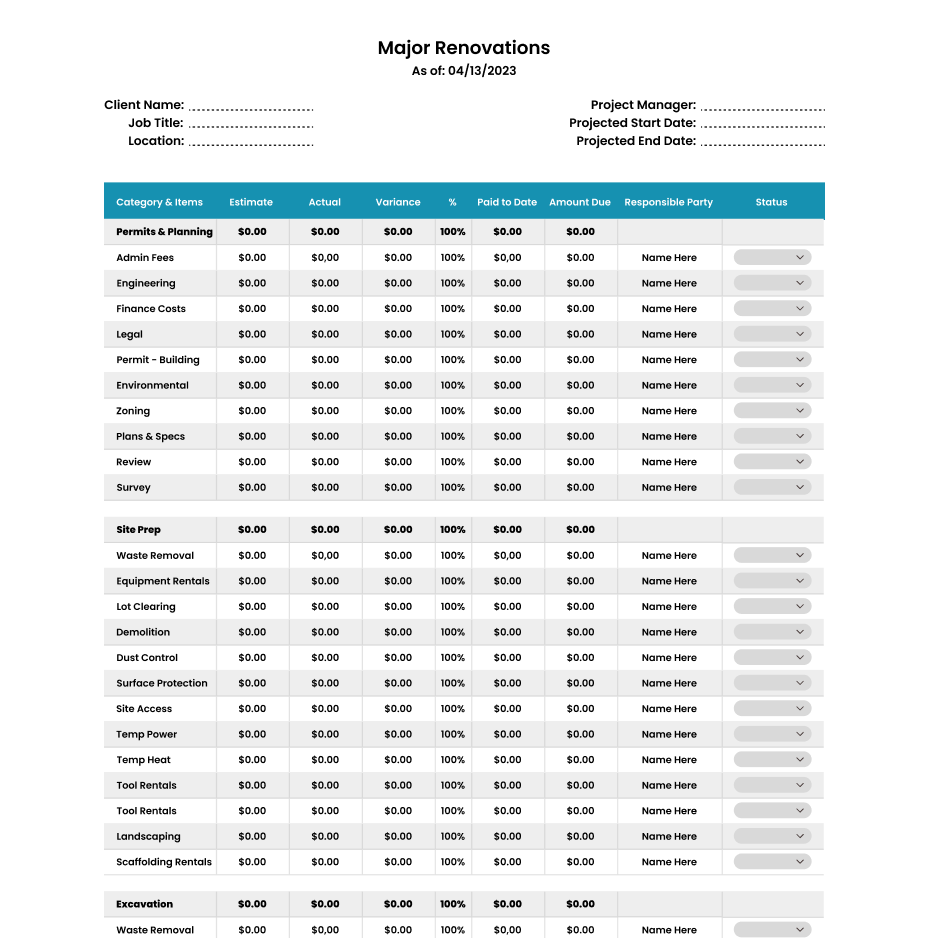

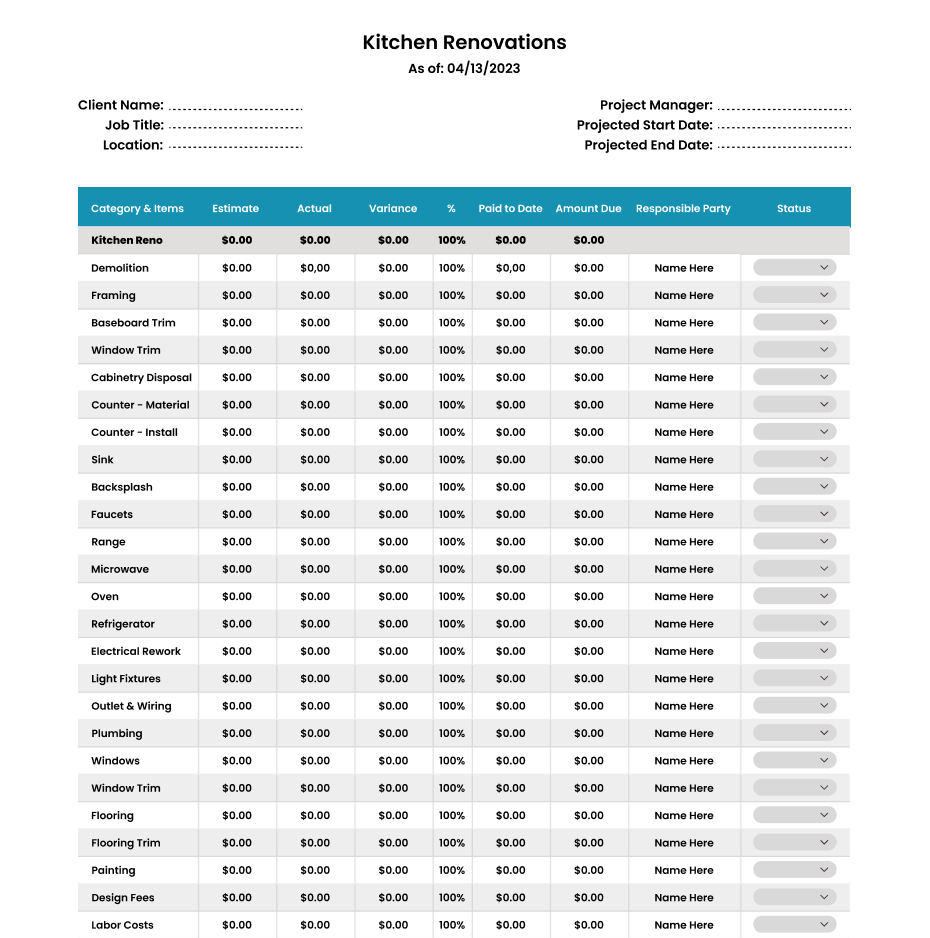

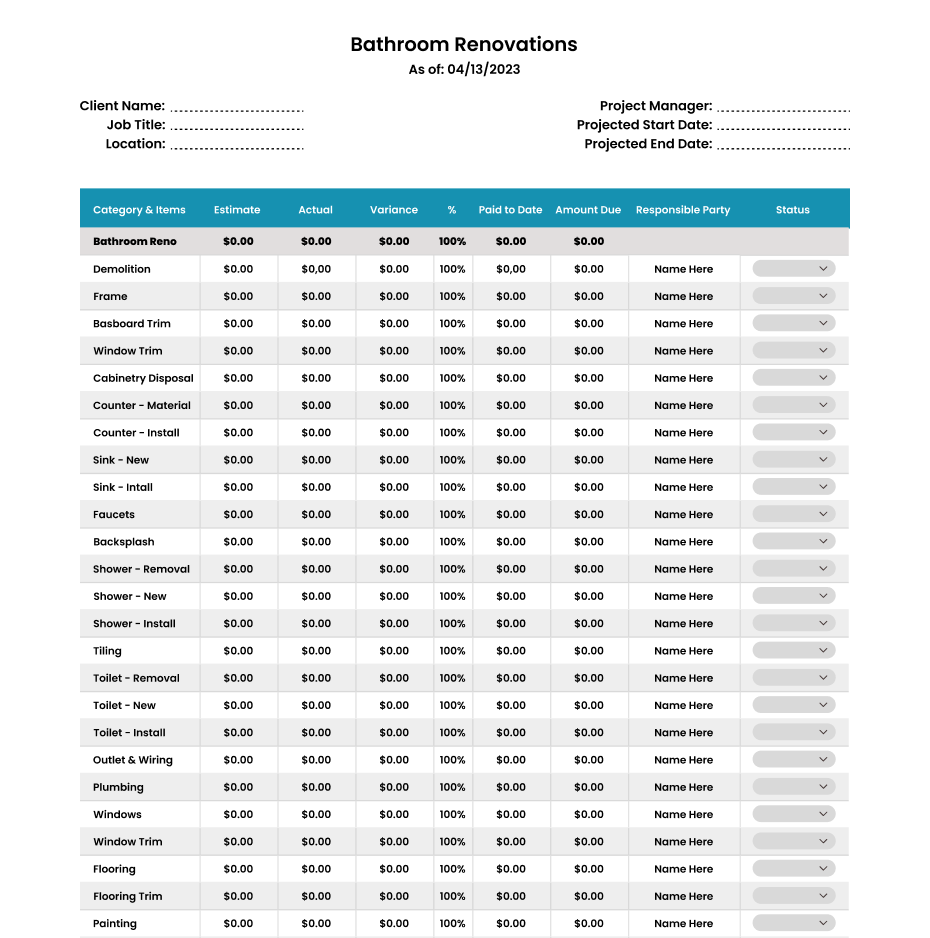

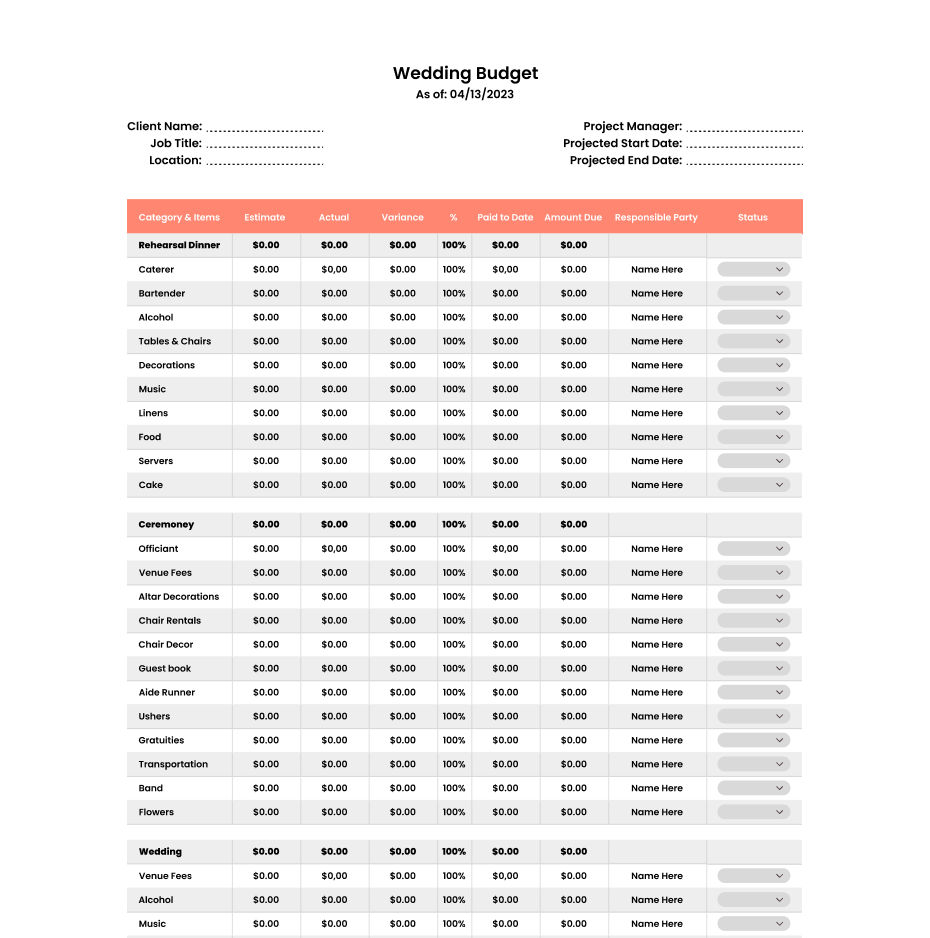

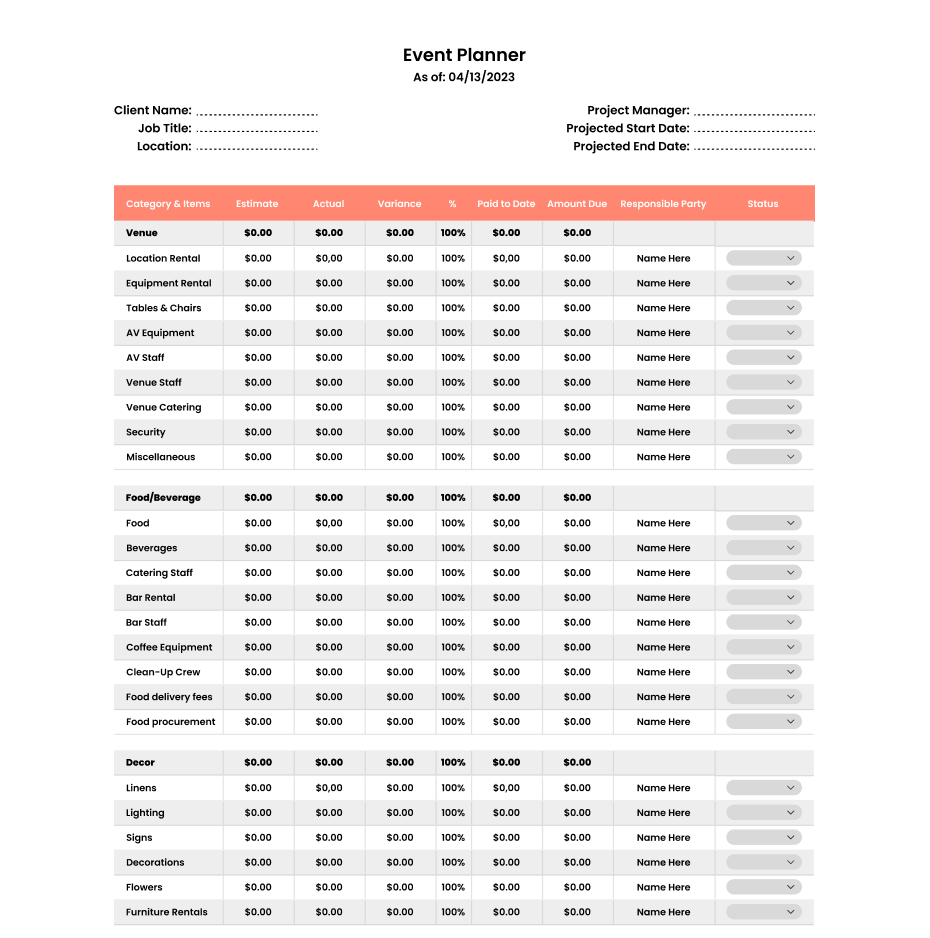

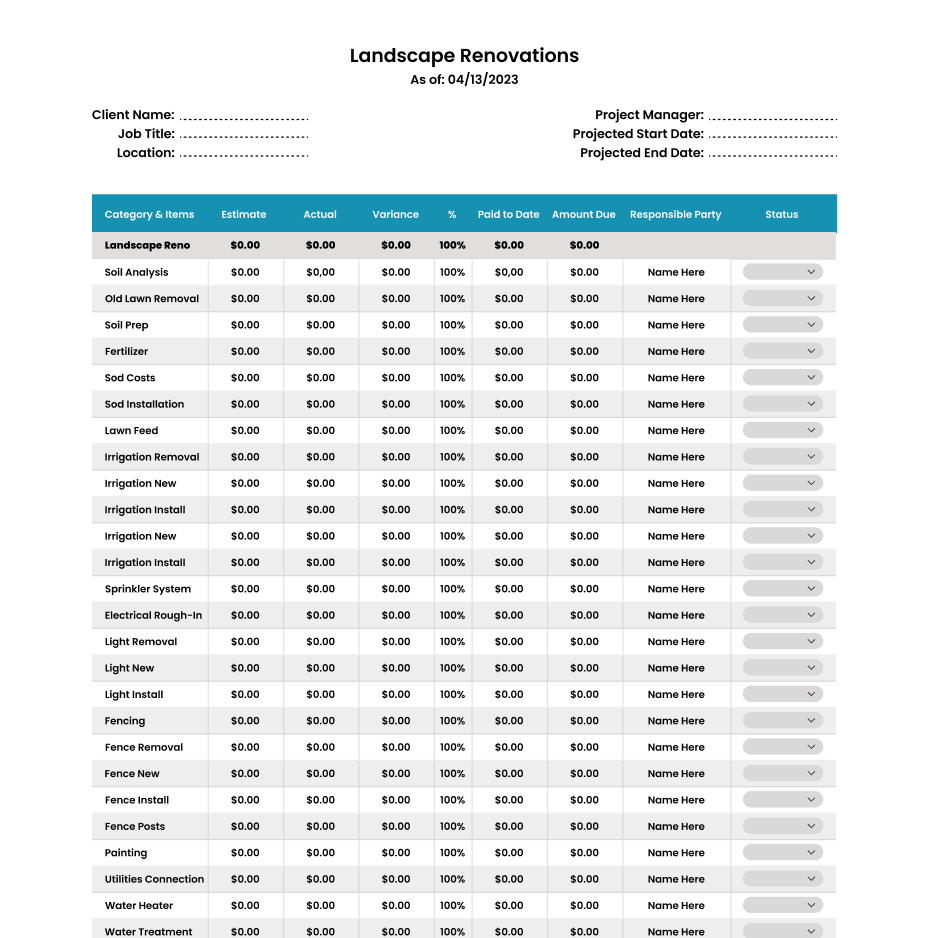

Project/Job description

A brief description of the project or job that the budget relates to.

Client Info

Add any pertinent info that you would like to include relating to your client, where the job is located, or a slightly more detailed description of the project.

Professional Info

Include your professional information to make sure that your client can reach out to you if they have any questions, as well as a broad estimate of how long the project will take you.

Category/Item Info

Include detailed descriptions of every item, tool, material, or cost that you think will go into the project.

Cost Info

This is the important part - be sure to include detailed cost information for every line item that you’ve listed under the ‘Category & Items’ section.

Payment Info

Include any information about items that have been pre-paid for, or items that have recently become payable or due.

Project Specific Info

Adding project specific info will help you build trustworthy client relationships - and also let you know who is responsible for individual tasks in the event of more complex projects.

Progress bars for each line items

Progress bars will help you indicate exactly where each item stands at any given point in time - simply click the drop down tab and choose from a range of options!

Just starting with budget templates?

We totally get it. Just starting out is the most exciting time for a small business owner, congratulations on your new venture! To help you get going, we’ve gathered some of our best knowledge for businesses just like yours, so you can understand your numbers ASAP.

Check out this detailed guide on how to use a budget template.

Or keep reading, and let’s get budgeting!

What's a business budget?

What makes a good budget?

Do budget templates work for all businesses?

How can I automate my

budgeting?

What's a business budget?

A business budget is an outline of your different sources of income and what you will spend your money on. This should be a detailed plan of what your expenses will be monthly or annually, so you can make sure you’re never strapped for cash.

What makes a good budget?

A good budget measures estimated spending against actual spending for a specific period of time. The budget should be realistic for your current business standing and should clearly show you any variance in your spending so that you can adjust accordingly when required.

Do budget templates work for all businesses?

Yes! Budget templates can be adjusted to work for any type of business. And every business, no matter how small, should have a budget in place. That’s why we offer a variety of different templates that are pre-populated with specific categories catering to different types of businesses. Check out all of our budget templates to find one that works for you!

How can I automate my budgeting?

No longer want to manually track your budgeting? Check out TrulySmall Expenses, the easiest way to automate your expense tracking and budgeting workflow. Simply connect your bank account and forget ever having to manually enter spending or transactions again! We’ll even notify you when you’re getting close to hitting your budget limit. Try it out for free today!

Benefits of using a budget template

Budgeting is critical to your small business’ health. It gives you the knowledge and insight you’ll need to eliminate wasteful spending, understand your cashflow, and become profitable quicker.

A well planned small business budget will show you how many sales you need to cover your expenses. From there, you’ll have better understanding of how much you have left to reinvest into your business.

Understand your spending

Budget templates help you understand your spending month after month. With proper budget tracking using our free budget template, you can stop worrying about overspending.

Easy to use and access

Access your digital budget template from anywhere so you know how your spending is doing at any time. All of our budget templates are designed to be user-friendly yet professional so you can get started right away.

Know you're tracking everything correctly

Our free budget templates are accountant-approved and you can be confident you’re tracking everything in CRA and IRS approved categories. Not only is it easy to understand and use, but it’ll make your tax-filing process more stress-free as well.

Send your budget easily

Send your small business budget to a team member, accountant, or partner easily by email. Avoid the clutter and mess of using physical budgets.