Today’s Entrepreneurial Workforce

The independent workforce is constantly growing. Contractors are also providing more add-on services as they go based on client needs. As a result, there just isn’t enough time for construction and trades professionals to learn the backend of running a successful business: namely, the accounting and finances.

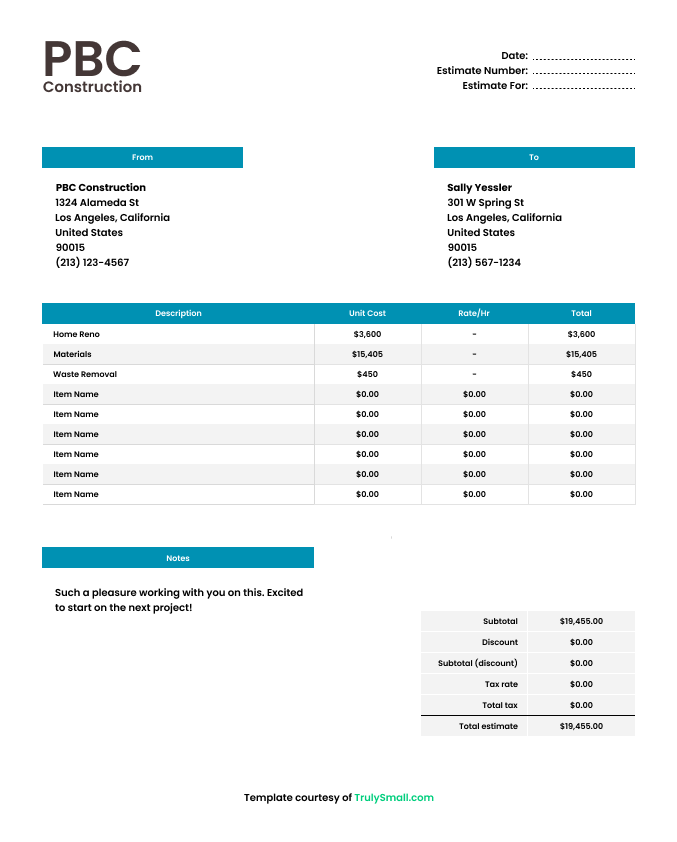

These invoice templates will help guide you to inputting your hours and materials in a professional manner—so that you can keep your cash flowing.

What should I include in my contractor invoice?

Is invoicing new to you or just a little bit convoluted? Here’s what to include on your contractor invoice template to keep getting paid the right amount and on time, every time! Your contractor invoice should include fees for consultation, labour, and materials. Some contractors provide free consultations as a way to onboard more clients, but that strategy can be entirely up to you. At a minimum, here’s what to include in your contractor invoice.

Your business name

Always include your company’s name on any type of financial reporting document.

Business contact information

Including a seller contact helps your customer know how to contact you with questions about the invoice. It also puts you as the point of contact for all future work.

Invoice number

Your business name is a foundational element of a professional invoice. It identifies your business and establishes your brand. Adding a business logo will provide a professional touch.

Payment terms

Small businesses mainly use: due on receipt, net-15, 30, and 60. For example, net-15 days tells your client that the invoice is due 15 days after the invoice date. The invoice payment terms depend on your relationship with your customer, common practices in your industry, and your cash flow needs.

Due date

The combination of the Invoice Date and Payment Terms provides the Due Date. A due date clearly indicates to your client when they should pay.

Pro tip: Setting up payment reminders can help keep your client on schedule to pay the invoice.

Bill to (who's going to pay)

Provides the name and contact information of the person the invoice is intended for (aka your client)

Product or service detail

Similar to your Statement of Work (SOW), here’s when you specify Description, Quantity, Rate, Amount, and Subtotal. The more detailed this section is, the better clarity you provide to your client—who needs to understand what they are paying for on the invoice.

Sales tax

Depends on the jurisdiction and business type. Check the local tax bureau to include the appropriate tax amount on your invoice.

Pro tip: Use an invoicing app like TrulySmall™ to manage business transactions, change tax settings easily, and just make doing your accounting and taxes more easy and efficient.

Discount

Provide discounts to your clients to give them initiative to pay earlier, for example. If you are going that route, include the number here as a percentage or actual amount.

Notes

A simple, personalized note will bring even more clarity to your client and leave a long-lasting, positive impression with the client—which should increase the chance of your invoice getting paid faster.

Other details can include payment instructions (i.e. Venmo, e-Transfer, or bank cheque), discount details, warranty information, or anything else relevant to the project or business opportunity.

11 simple steps to building your contractor invoice

To create your contractor invoice, first download the free, customizable template. Next, fill in business information, client details, services, time and materials, and fees. Different contractors have their own unique way of getting the job done—including how they charge for their work. Tailor these details to your work and your client.

Want a quick and streamlined lesson? Follow the instructions below to create your independent contractor invoice from beginning to end.

1. Download the template

Download any of our free contractor invoice templates from the top of this web page. No matter what format you need, we’ve got you covered.

2. Input your info

Input your info into the downloaded invoice.

3. Add your logo

Add your logo to the invoice for a professional, branded look.

4. Include client’s info

Include all of your client’s details like their full name, billing address, and contact information.

5. Add a unique logo

Add a unique invoice number so you can keep track of all your invoices. We recommend starting with 00001 and moving up.

6. List what you did

List out all of the services and parts/materials you provided in separate lines under ‘Description’.

7. Calculate the total

Calculate your subtotal by adding up all of the amounts you charged for services.

8. Add the tax

Include any taxes you may need to charge, other fees, or offer a discount.

9. Include your terms

Clarify your payment terms and whether there are any late fees associated with your invoice.

10. How can they pay you

Include any information your client will need to pay you! (Your PayPal email, your venmo account, etc.)

11. Send the invoice

Export to PDF and hit send! And Voila! You’re on your way to getting paid.

When should I send my contractor invoice?

Many contractors have their own way of sending invoices. Some invoice at the beginning of the month, while others invoice at the end of the month to reduce time spent preparing paperwork. Small business experts recommend sending invoices as soon as you complete a project.

By invoicing right away, you stay on top of cash flow and avoid carrying your client’s debt for longer than necessary. After all, your payment date is influenced by your invoice date. The more you wait on sending out your invoice, the longer of a lag time you’ll have to get paid. Invoicing software is a great tool for independent contractors to automate the invoicing process.

Sick of manually creating invoices? Check out TrulySmall Invoices!

TrulySmall Invoices is the easiest invoicing app for small businesses. Send an estimate before your project starts to lock in your pricing, track your invoice statuses, and collect payments digitally with our Stripe integration! We’ll even handle invoice follow-ups for you so that you’re getting paid on time!

Save time and get peace of mind. Start invoicing with TrulySmall Invoicing for free!

Why is sending professional invoices important for contractors?

Keep it professional

Easy-to-understand, professional-looking invoices reinforces your reputation in the industry and positions you as a trusted and reputable contractor. Your clients will have your company name at the top of mind, especially when a new work opportunity comes your way.

Keep it relatable

By sending a contractor invoice, you’re making it relatable to your construction trade, which further strengthens your overall brand. Using one of our contractor invoice templates will help ensure that you’re using the correct fields on your invoice and you’re covered for all your costs.

Don’t forget materials

Contractors working in trades are generally expected to purchase supplies or parts to complete the work for a client. This cost is typically passed along to your client in the invoice with a mark-up: this is a percentage added to the material price to take home as profit, so don’t forget to include it!

I don’t want to use an invoice template—how does Truly Small Invoicing help my business?

TrulySmall’s contractor invoice template was created for contractors who are busy and need a quick and efficient way to invoice clients for free. No matter what service you provide, the contractor invoice template is structured in a straightforward way for you to input the details that matter most for your clients and for you getting paid.

But if you’re looking to further streamline your contractor invoicing process, TrulySmall Invoices can help automate the process even more than our customized templates can.

Piqued your interest?

Try out Truly Small Invoicing today to find out how our software can automate your invoicing process.