Free Invoicing Templates for Small Business Owners

Download and customize free invoicing templates from TrulySmall and wow your clients with a branded, personalized, and professional invoices.

Want an easier tool for invoicing?

Tired of creating estimates or invoices manually AND trying to keep track on a spreadsheet? Us too. We’ve created a free app that helps you create & track invoices and estimates, collect payments, and reconcile your income.

Download our iOS or Android app and start sending invoices and estimates for free!

Want a tool for invoicing and accounting?

Check out TrulySmall™ Accounting.

What is an invoice?

An invoice is a document issued by a business to indicate a transaction, and to request payment for a product or service provided.

Often called a sales invoice or bill, invoices are a crucial component of any business. Invoices help you get paid on time and keep track of all your accounts to sustain cash flow. When done correctly, invoices can help build long-term business relationships with customers.

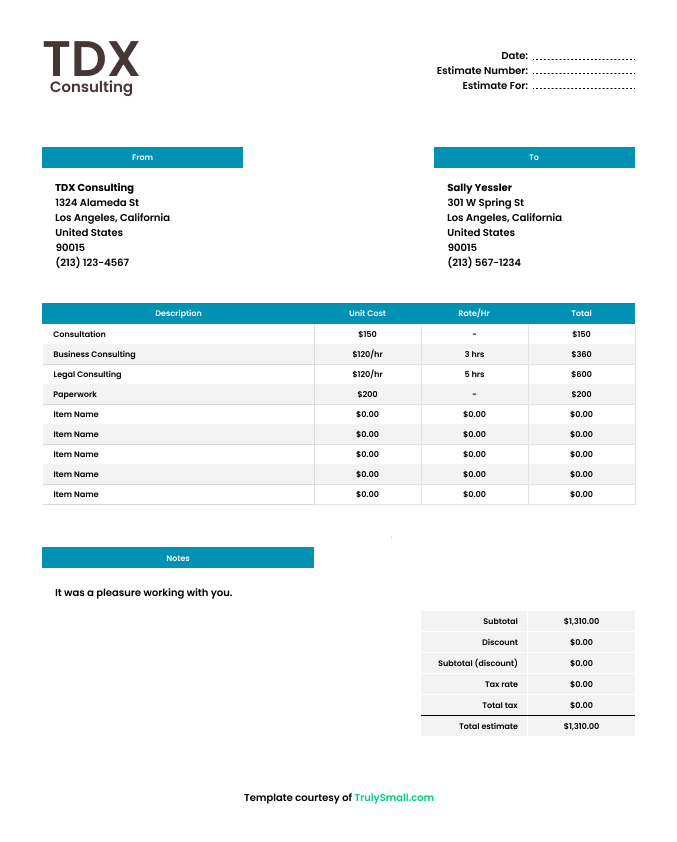

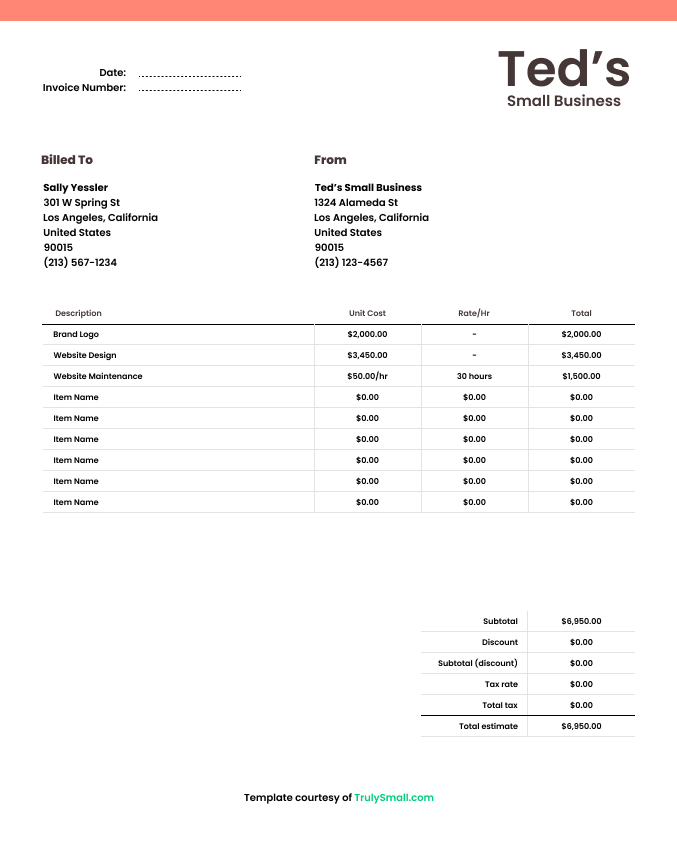

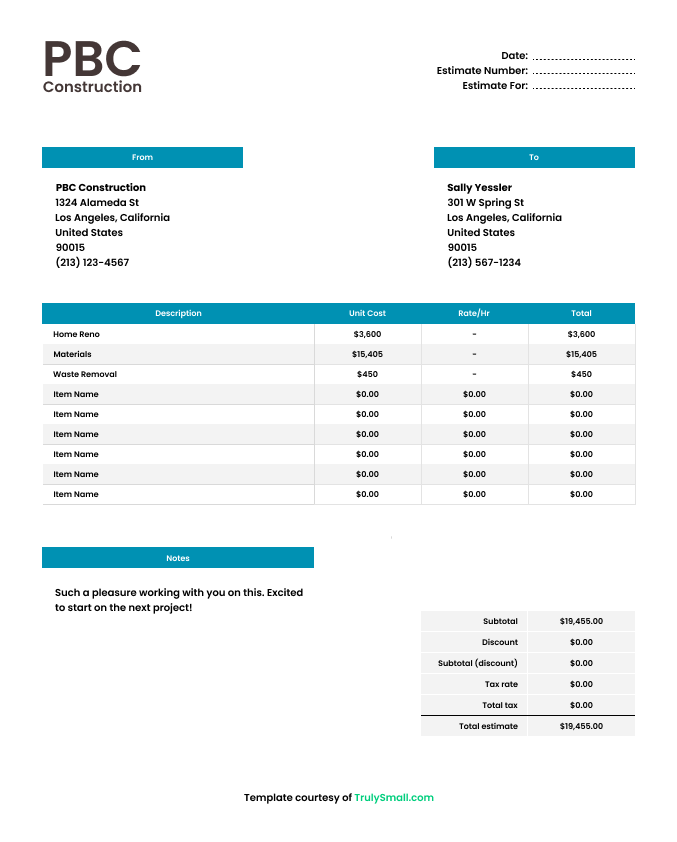

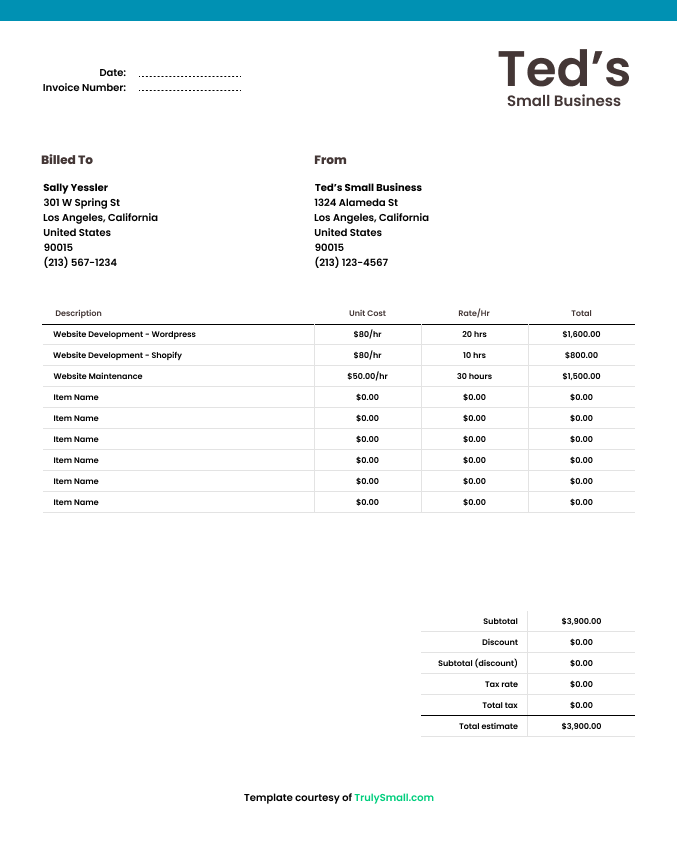

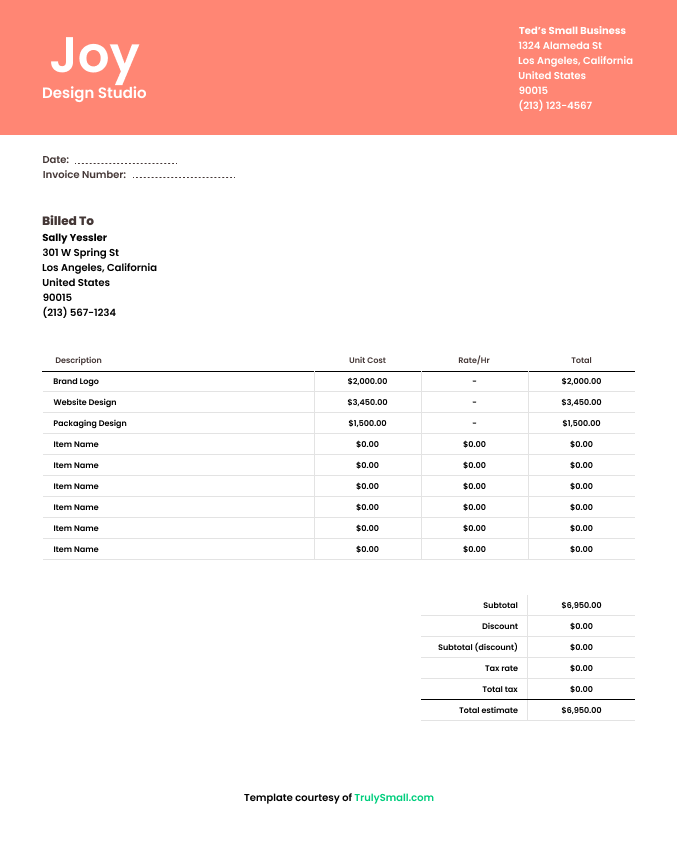

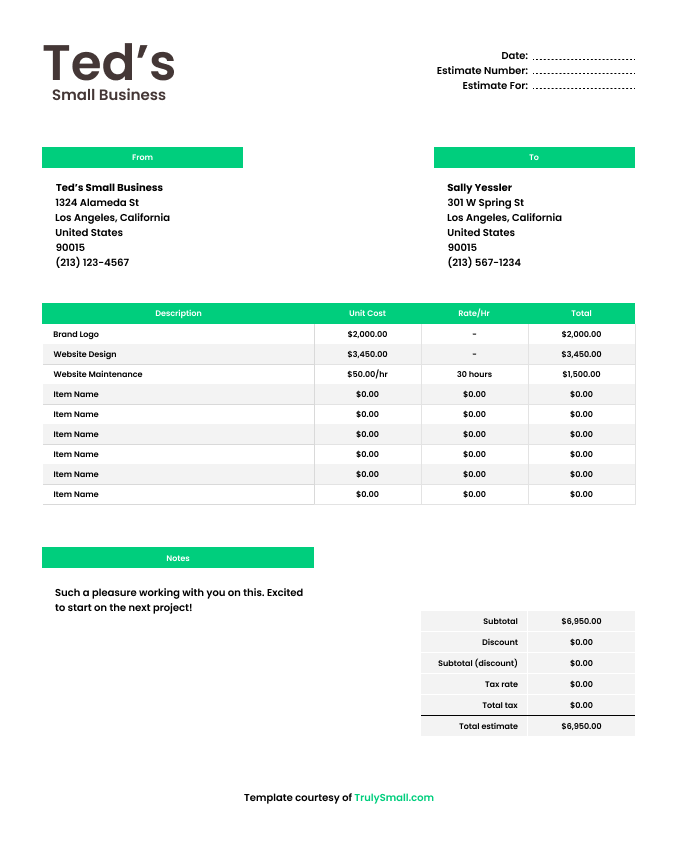

The Anatomy of an Invoice

Your business name

Always include your company’s name on any type of financial reporting document.

Business contact information

Including a seller contact helps your customer know how to contact you with questions about the invoice. It also puts you as the point of contact for all future work.

Invoice number

Your business name is a foundational element of a professional invoice. It identifies your business and establishes your brand. Adding a business logo will provide a professional touch.

Payment terms

Small businesses mainly use: due on receipt, net-15, 30, and 60. For example, net-15 days tells your client that the invoice is due 15 days after the invoice date. The invoice payment terms depend on your relationship with your customer, common practices in your industry, and your cash flow needs.

Due date

The combination of the Invoice Date and Payment Terms provides the Due Date. A due date clearly indicates to your client when they should pay.

Pro tip: Setting up payment reminders can help keep your client on schedule to pay the invoice.

Bill to (who's going to pay)

Provides the name and contact information of the person the invoice is intended for (aka your client)

Product or service detail

Similar to your Statement of Work (SOW), here’s when you specify Description, Quantity, Rate, Amount, and Subtotal. The more detailed this section is, the better clarity you provide to your client—who needs to understand what they are paying for on the invoice.

Sales tax

Depends on the jurisdiction and business type. Check the local tax bureau to include the appropriate tax amount on your invoice.

Pro tip: Use an invoicing app like TrulySmall™ to manage business transactions, change tax settings easily, and just make doing your accounting and taxes more easy and efficient.

Discount

Provide discounts to your clients to give them initiative to pay earlier, for example. If you are going that route, include the number here as a percentage or actual amount.

Notes

A simple, personalized note will bring even more clarity to your client and leave a long-lasting, positive impression with the client—which should increase the chance of your invoice getting paid faster.

Other details can include payment instructions (i.e. Venmo, e-Transfer, or bank cheque), discount details, warranty information, or anything else relevant to the project or business opportunity.

Just starting with invoices?

We totally get it. Just starting out is the most exciting time for a small business owner, congratulations on your new venture! To help you get going, we’ve gathered some of our favourite information for businesses just like yours so you can get paid and get the cash flowing ASAP.

Soon, you’ll be able to download our free comprehensive PDF guide to “Invoicing for Truly Small Businesses”, or keep reading, and let’s get growing.

What's an Invoice?

What do I put on an invoice?

What kind of file do I send?

How do I get paid?

What's an Invoice?

An invoice is what you send a client after you’ve delivered your product, but before you get paid. The invoice tells your client how much they need to pay you, and sets the payment terms they need to follow. Sellers sometimes call it a “sales invoice.”

What do I put on an invoice?

- Business name, logo & contact info

- Invoice number

- Payment terms & Due date

- Bill to (payer contact information)

- Product or service details

- Sales tax, Discount (If any) & Total

- Notes

What kind of file do I send?

The best type of file to send to your clients is a PDF file. The PDF is a great format for professional correspondence because it’s universal, versatile, and accessible. It also has the perfect balance of file size and quality making it the ideal choice when invoicing clients.

You can still use any of the free invoice template formats TrulySmall™ offers. When you are ready to export, export to PDF, and attach your file to your email!

How do I get paid?

The important part - how to get paid! There’s no right answer to this question, but the majority of small business owners are turning to digital payments to get paid in today’s economy. And it’s no secret why - accepting credit, debit, and ACH payments is the fastest, most secure way to get paid. And if you’re ready for a more streamlined approach when it comes time to getting paid - check out how we support digital payments at TrulySmall Invoices!check out how we support digital payments at TrulySmall Invoices!

Benefits of using a free downloadable invoicing template

Invoicing is at the core of any business—it impacts revenue and ultimately, cash flow. Whether an invoicing template or an online invoicing software is the route you want to take, the key is to do it in the most efficient way possible.

Here are some of the many benefits of choosing the online invoicing route for your truly small business.

Understand your finances

Track all of your income easily using our free downloadable invoice templates! Using an organized and professional template makes it super easy to see your progress over time and how much you invoiced each client.

Easy to use

All of our free invoicing templates are designed to be user-friendly while still looking professional. Know exactly what you should be filling out each time to maintain great financial record-keeping.

Saves you time

Small business owners are busy enough and don’t have time to think about what needs to go on an invoice each time they send one! Downloading and using a free invoice template ensures you never have to worry about missing information.

Send your invoices to anyone

By using our free invoicing template, it’s super easy to send the document to your team, your accountant, or whoever else needs it! You can also choose to send either a physical copy or a digital copy. Our templates come in excel, Google sheets, or PDF formats so you can choose what’s best for you and your business.