Free Consultant Invoice Template

Consultants specialize in varying niches and disciplines and are often seen as an expert in their field. Your busy days are filled with working with organizations of all sizes to improve their business performance.

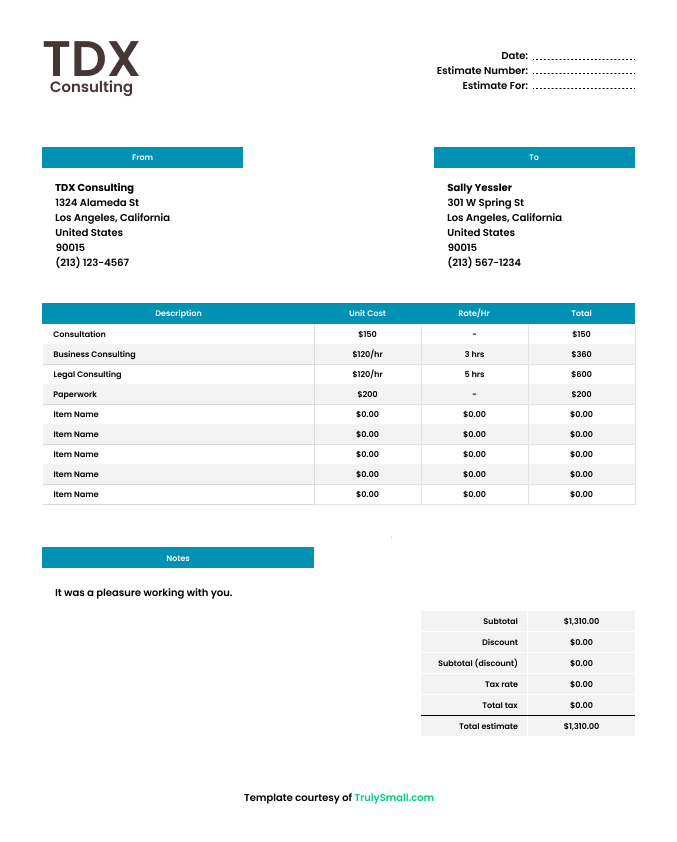

This is where TrulySmall comes in. We provide a range of customizable consultant invoice templates for you to seamlessly invoice clients and most importantly, get paid.

Download as:

<span data-metadata=""><span data-buffer="">Today’s Entrepreneurial Workforce

The independent workforce is constantly growing. Consultants are also providing more add-on services as they go based on client needs. As a result, there just isn’t enough time for construction and trades professionals to learn the backend of running a successful business: namely, the accounting and finances.

These invoice templates will help guide you to inputting your hours and materials in a professional manner—so that you can keep your cash flowing.

What should I include in my contractor invoice?

As a consultant, you likely already regularly track your time, are familiar with your hourly rate, and are used to invoicing—depending on your pool of clientele and the amount of work receive regularly.

But if invoicing is new to you, there are a couple of key items that you cannot neglect on your consultant invoice, including a unique invoice number, the invoice date, sales tax, and payment terms.

By using TrulySmall’s free consulting invoice template, you will not miss these critical items related to your consulting work. Our invoice templates include prompts to add your consulting business logo, the invoice number, client details, hourly rate field, and more. At the bare minimum, here’s what you should include on your consulting invoices to keep your invoices looking and feeling professional:

Your business name

Always include your company’s name on any type of financial reporting document.

Business contact information

Including a seller contact helps your customer know how to contact you with questions about the invoice. It also puts you as the point of contact for all future work.

Invoice number

Your business name is a foundational element of a professional invoice. It identifies your business and establishes your brand. Adding a business logo will provide a professional touch.

Payment terms

Small businesses mainly use: due on receipt, net-15, 30, and 60. For example, net-15 days tells your client that the invoice is due 15 days after the invoice date. The invoice payment terms depend on your relationship with your customer, common practices in your industry, and your cash flow needs.

Due date

The combination of the Invoice Date and Payment Terms provides the Due Date. A due date clearly indicates to your client when they should pay.

Pro tip: Setting up payment reminders can help keep your client on schedule to pay the invoice.

Bill to (who's going to pay)

Provides the name and contact information of the person the invoice is intended for (aka your client)

Product or service detail

Similar to your Statement of Work (SOW), here’s when you specify Description, Quantity, Rate, Amount, and Subtotal. The more detailed this section is, the better clarity you provide to your client—who needs to understand what they are paying for on the invoice.

Sales tax

Depends on the jurisdiction and business type. Check the local tax bureau to include the appropriate tax amount on your invoice.

Pro tip: Use an invoicing app like TrulySmall™ to manage business transactions, change tax settings easily, and just make doing your accounting and taxes more easy and efficient.

Discount

Provide discounts to your clients to give them initiative to pay earlier, for example. If you are going that route, include the number here as a percentage or actual amount.

Notes

A simple, personalized note will bring even more clarity to your client and leave a long-lasting, positive impression with the client—which should increase the chance of your invoice getting paid faster.

Other details can include payment instructions (i.e. Venmo, e-Transfer, or bank cheque), discount details, warranty information, or anything else relevant to the project or business opportunity.

11 simple steps to building your contractor invoice

To create your consultant invoice, first download the free, customizable template. Next, fill in business information, client details, services, time and materials, and fees. Different consultants have their own unique way of getting the job done—including how they charge for their work. Tailor these details to your work and your client.

Want a quick and streamlined lesson? Follow the instructions below to create your independent contractor invoice from beginning to end.

<span data-metadata=""><span data-buffer="">1. Download the template

Download any of our free consultant invoice templates from the top of this web page. No matter what format you need, we’ve got you covered.

<span data-metadata=""><span data-buffer="">2. Input your info

Input your info into the downloaded invoice.

<span data-metadata=""><span data-buffer="">3. Add your logo

Add your logo to the invoice for a professional, branded look.

<span data-metadata=""><span data-buffer="">4. Include client’s info

Include all of your client’s details like their full name, billing address, and contact information.

<span data-metadata=""><span data-buffer="">5. Add a unique logo

Add a unique invoice number so you can keep track of all your invoices. We recommend starting with 00001 and moving up.

<span data-metadata=""><span data-buffer="">6. List what you did

List out all of the services you provided in separate lines under ‘Description’.

<span data-metadata=""><span data-buffer="">7. Calculate the total

Calculate your subtotal by adding up all of the amounts you charged for services.

<span data-metadata=""><span data-buffer="">8. Add the tax

Include any taxes you may need to charge, other fees, or offer a discount.

<span data-metadata=""><span data-buffer="">9. Include your terms

Clarify your payment terms and whether there are any late fees associated with your invoice.

<span data-buffer="">10. How can they pay you<span data-metadata="">

Include any information your client will need to pay you! (Your PayPal email, your venmo account, etc.)

<span data-buffer="">11. Send the invoice<span data-metadata="">

Export to PDF and hit send! And Voila! You’re on your way to getting paid.

When should I send my consultant invoice?

Consultants tend to charge clients by the hour, but not every consultant operates the same. Tracking billable hours and invoicing clients for your time is a key component of invoicing in the consulting industry. Do your research when it comes to hourly rates as this can vary depending on your niche, experience level, business region, and client budget and expectations.

Once you’ve secured your client and nailed down your rate, get into the habit of tracking your hours automatically to reduce overall administration. Doing this will make invoicing as a consultant that much easier.

<span data-metadata=""><span data-buffer="">Sick of manually creating invoices? Check out TrulySmall Invoices!

TrulySmall Invoices is the easiest invoicing app for small businesses. Send an estimate before your project starts to lock in your pricing, track your invoice statuses, and collect payments digitally with our Stripe integration! We’ll even handle invoice follow-ups for you so that you’re getting paid on time!

Save time and get peace of mind. Start invoicing with TrulySmall Invoicing for free!

<span data-metadata=""><span data-buffer="">3 Top Tips on invoicing as a Consultant

Track your time<span data-metadata="">

Leverage time tracking tools or install browser extensions that track time for you without you having to lift a finger. You might even want to track your billable hours on an up-to-date timesheet. Adding a timesheet is also a great way to boost transparency with your client.

Invoice consistently

“>As a consultant, keeping the revenue flowing in is a key objective. That’s why the sooner you invoice, the sooner you get paid. Get into the habit of invoicing right at completion to ensure you get paid as quickly as possible.

Formulate clear terms

Establishing clear terms on your consulting invoice will manage expectations, communicate professionalism, and serve as a safety net for all things related to payments and cash flow. Verbally communicate these terms with your clients prior to setting up a contract and if that’s not possible, make sure that it’s written in the contract as well as your invoice.

I don’t want to use an invoice template—how does Truly Small Invoicing help my business?

TrulySmall’s consultant invoice template was created for consultants who are busy and need a quick and efficient way to invoice clients for free. No matter what service you provide, the consultants invoice template is structured in a straightforward way for you to input the details that matter most for your clients and for you getting paid.

But if you’re looking to further streamline your consultant invoicing process, TrulySmall Invoices can help automate the process even more than our customizable templates can.