Free Financial Report Templates for Small Business Owners

Download our free TrulySmall financial report templates and get a handle on your small business finances! We’ve got you covered with balance sheets, income statements, annual reports, cashflow statements, and more!

Free Financial Report Templates

Want to automate your entire small business reporting process?

Tired of manually filling in financial reports for your business? Automate your entire accounting and bookkeeping process with TrulySmall Accounting! Just connect your bank and we’ll give you populated financial reports in 5 minutes or less.

What is a financial report?

Financial reports help to show the business activity and financial performance of a small business. They’re required for audits and tax filing, and are a great tool to use to guide your business decisions.

The 3 main financial statements that all businesses need are balance sheets, a profit and loss statement (aka income statement), and a cash flow statement. There are also many other financial reports that could be super helpful when trying to understand your business financials.

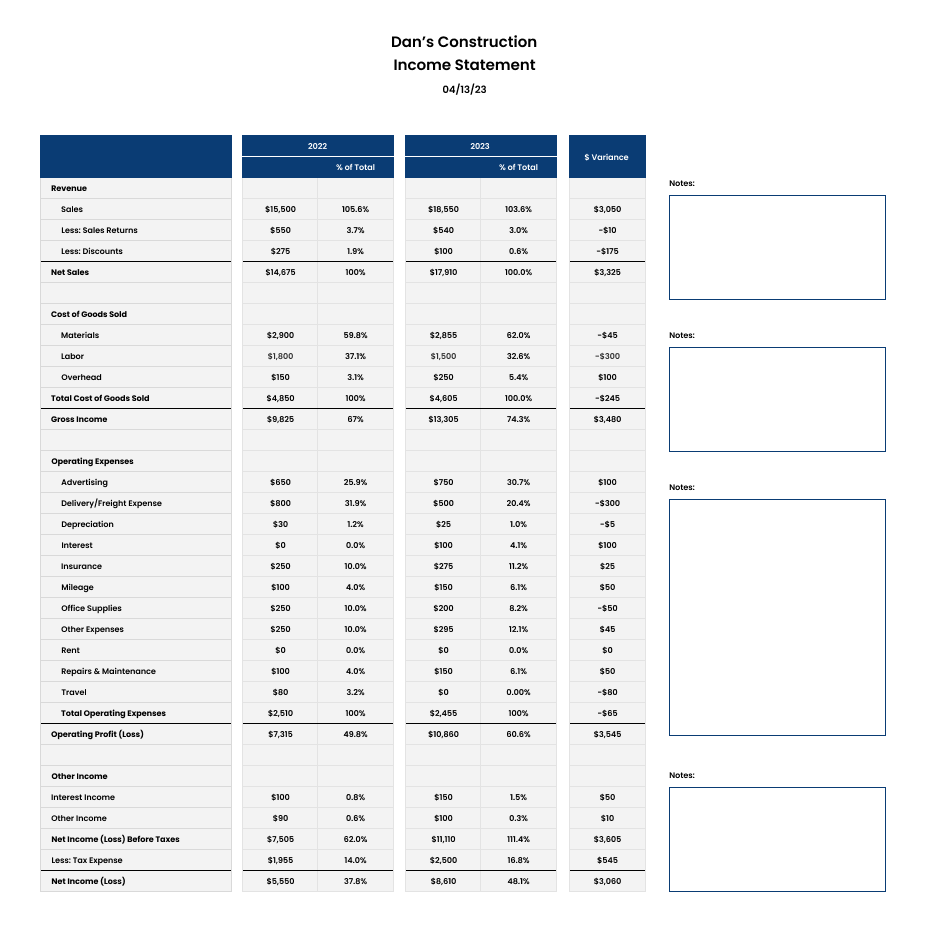

The Anatomy of an Income Statement

Your Company's Name

Always include your company’s name on any type of financial reporting document.

Financial Statement's Title

This one’s simple: be sure to specify the type of financial report and/or document that is being prepared!

Reporting Date

It’s important to include that your financial report was submitted on for future reference!

Revenue - Your Total Sales

Revenue is simply the total amount of money earned by your company through the sale of goods or services during a specific period of time, usually a month, quarter, or year.

Date Range

Be sure to include the time period that your income statement covers - this is typically a year or a quarter.

Year-Over-Year Changes

Variance simply logs any changes throughout the time period that your income statement covers.

COGS - What Your Total Sales Cost

COGS stands for "Cost of Goods Sold," which refers to the direct costs associated with producing or acquiring the products or services that your company sells.

Expenses

Expenses are simply the costs that you incur in order to operate and maintain your business on a daily basis. Examples include rent, utilities, salaries and wages, supplies, or advertising costs.

Other Income

Other income is simply money that your company has earned from sources outside of your primary business operations. Examples include interest paid from a business savings account, investment earnings, or proceeds from insurance.

Net Income - How Much You Made

Net income - this is the exciting one. It’s the key financial metric to understand and optimize for - because it’s the amount of income you made after subtracting all expenses and taxes from your company’s total revenue. More simply, it’s the amount of money that your company has earned, or lost, after accounting for all of your costs.

Just starting with financial reports?

We totally get it. Just starting out is the most exciting time for a small business owner, congratulations on your new venture! To help you get going, we’ve gathered some of our favourite information for businesses just like yours so you can get paid and get the cash flowing ASAP.

Soon, you’ll be able to download our free comprehensive PDF guide to “Invoicing for Truly Small Businesses”, or keep reading, and let’s get growing.

What's a Profit and Loss Statement?

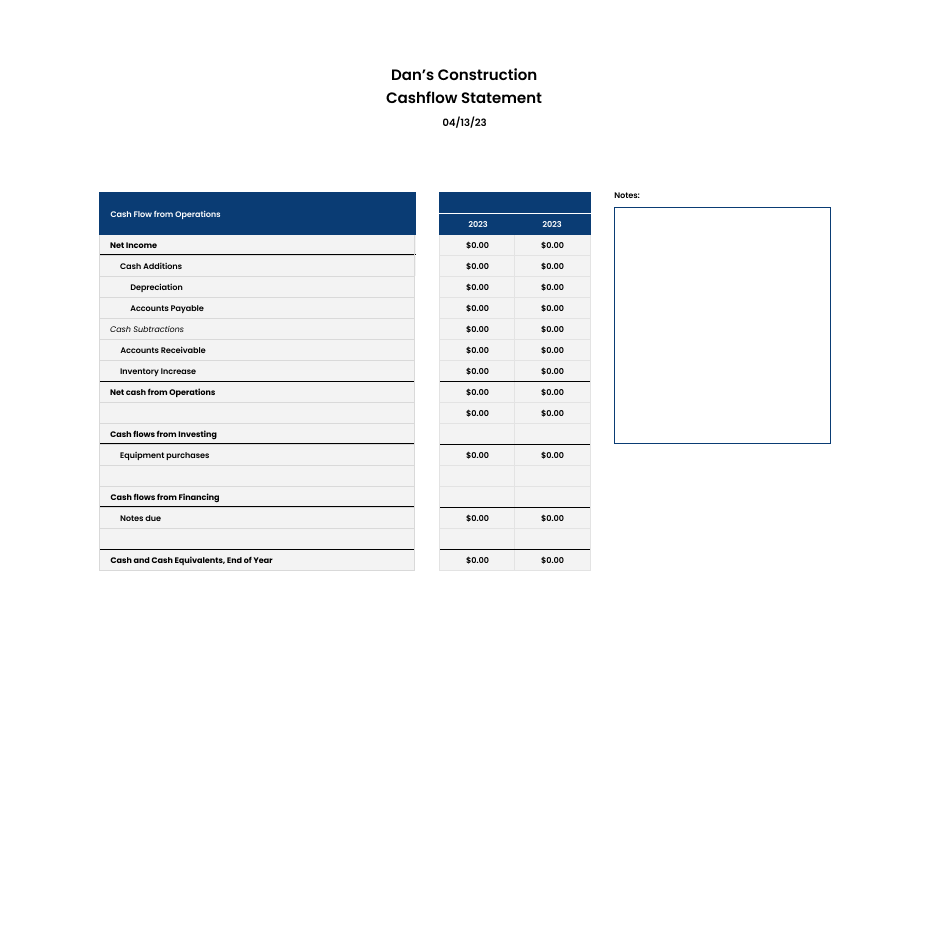

What's a Cash Flow Statement?

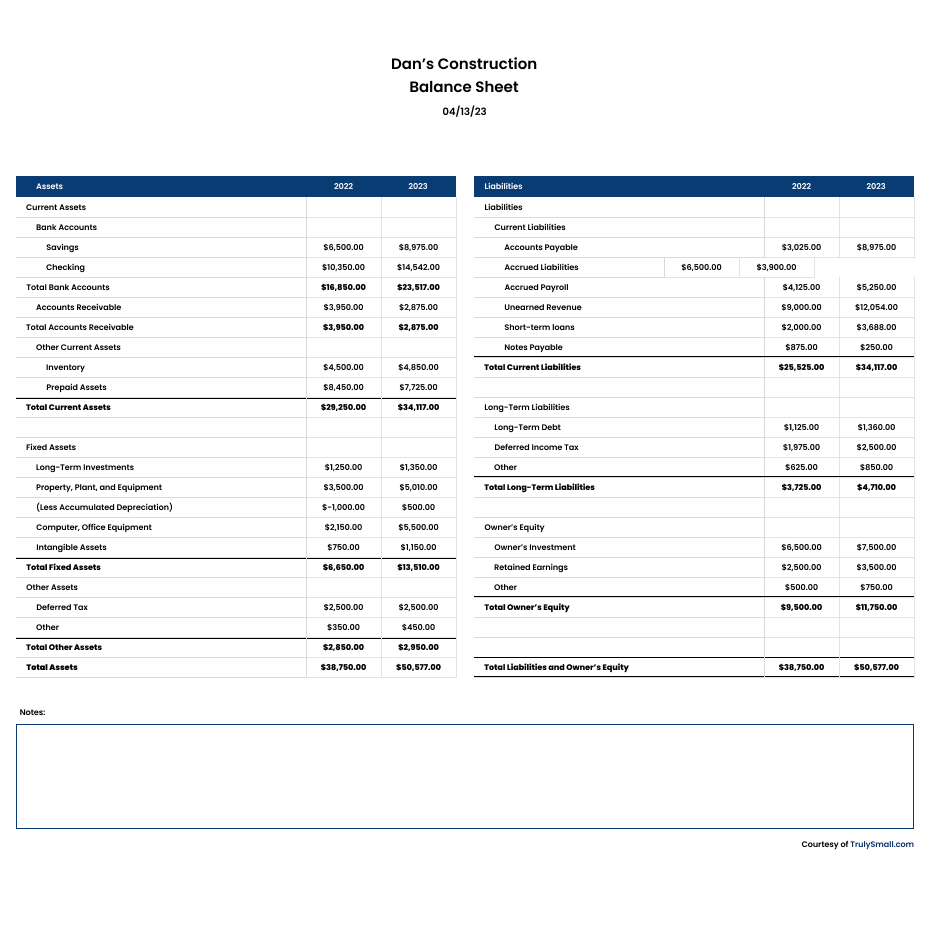

What's a balance sheet?

Why do I need financial statements?

What's a Profit and Loss Statement?

A profit and loss statement, or an income statement, summarizes a business’ revenues, expenses, gains, and losses over a specific period - typically a quarter or a year. The income statement takes all of these categories into consideration, and ultimately gives you a view of your net income, or losses, during that period.

What a cash flow statement?

The cash flow statement paints a picture of how your company’s operations are running, as well as where your money is coming from, and where your money is going. The goal of the cash flow statement is to understand everything about your cash position and how it has changed over a specific period of time - again, typically a quarter or a year.

What's a balance sheet?

A balance sheet shows the assets (what you own), liabilities (what you owe), and equity (the percentage of your assets are owned by outside parties. Balance sheets are typically used to provide a snapshot of your overall financial position at the end of a quarter or a year.

Why do I need financial statements?

Put simply, financial statements will give you a deeper understanding of how your business is doing at a given point in time. They are a crucial tool when it comes to analyzing, monitoring, and understanding your businesses financial health. Not to mention - maintaining detailed financial reporting throughout the entire year will help you tremendously when it comes to tax time. And, if you’re curious about how to take a more detailed approach to your financial reporting, check out how we can automate your entire accounting workflow at TrulySmall Accounting!

Benefits of using a free downloadable template

No entrepreneur started their business with a passion to do their accounting. But accounting and bookkeeping are 2 critical aspects of running any size of business! Whether you’re looking to learn more about your business or file your first year of taxes—we’ve got you covered with free downloadable financial statement templates!

Here are some of the many benefits of downloading and using a free financial statement template for your truly small business.

Focus on growing your business

Using a free downloadable template saves you from the time (and headache) of figuring out what you need to track and how to set each report up. This means less time in Excel and more time actually growing your business.

Make smarter business decisions

Gain deeper business insights when you use financial statements. Reports allow you to understand different aspects of your business, from your cash flow, to your best and worst clients.

Stress less about tax filing

Having your financial reports prepared saves you time when it’s time to file your taxes. If you’re hiring an accountant, all you’ll have to do is send over your Profit and Less Statement and they’ll have everything they need to get your taxes completed.

Less storage and clutter

By using a digital financial statement, you can minimize the clutter and paper storage in your life! All of our reports are either in Excel or Google Sheets format so you never have to print out another piece of paper to track your finances.