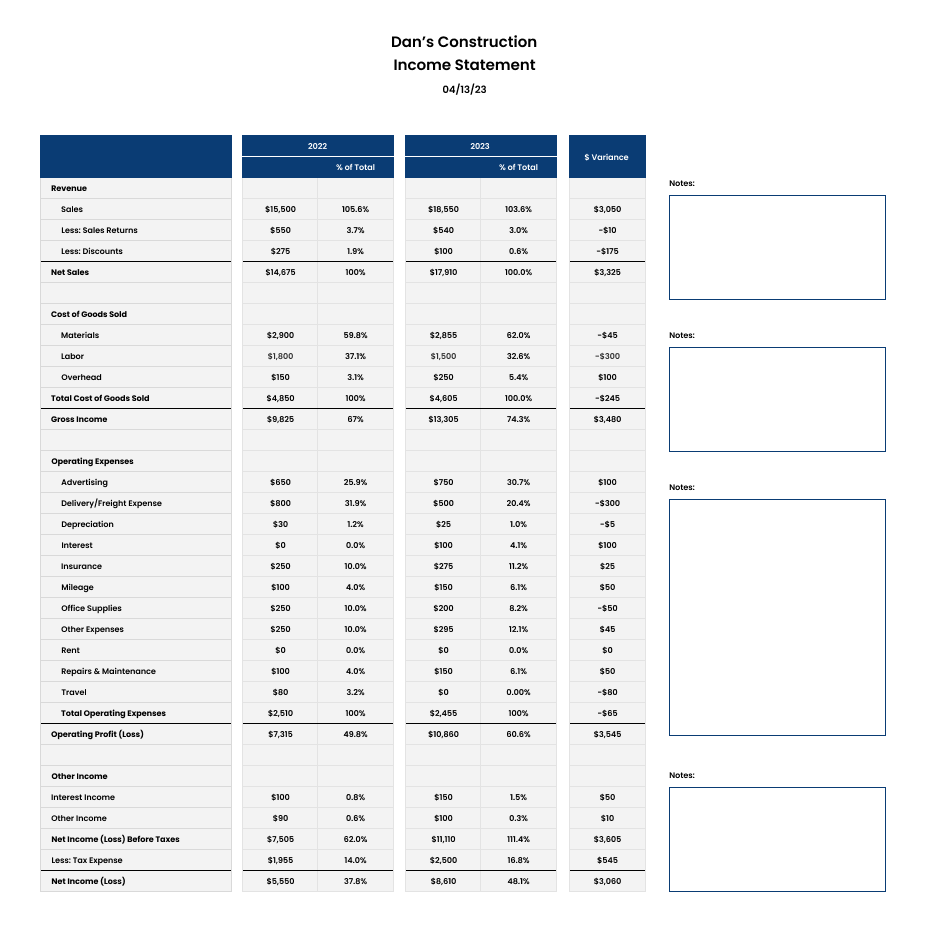

Free Income Statement Template

We get it. As a small business owner, your days are filled with providing services or creating products for your customers and the last thing on your mind is how to create a simple but professional Income Statement to track your finances.

Thank goodness Truly Small offers a range of customizable financial statement templates for you to download and use for free.

Download as:

Today’s Entrepreneurial Workforce

The independent workforce is constantly growing and small business owners find themselves wearing multiple hats everyday, as they learn to grow with their business.

As a result, there just isn’t enough time to learn the backend of running a successful business: namely, accounting and finances. These Income Statement templates will help guide you to inputting your financial data in a professional manner—so that you can keep your cash flowing.

What should I include in my Income Statement?

If tracking your financial data is new to you, here’s what to include on your income statement gain deeper insight into your business and be ready to file your taxes! Your small business Income Statement should include your revenue, cost of goods sold, operating expenses, and more. At a minimum, here’s what should be included on your Income Statement.

Your Company's Name

Always include your company’s name on any type of financial reporting document.

Financial Statement's Title

This one’s simple: be sure to specify the type of financial report and/or document that is being prepared!

Reporting Date

It’s important to include that your financial report was submitted on for future reference!

Revenue - Your Total Sales

Revenue is simply the total amount of money earned by your company through the sale of goods or services during a specific period of time, usually a month, quarter, or year.

Date Range

Be sure to include the time period that your income statement covers - this is typically a year or a quarter.

Year-Over-Year Changes

Variance simply logs any changes throughout the time period that your income statement covers.

COGS - What Your Total Sales Cost

COGS stands for "Cost of Goods Sold," which refers to the direct costs associated with producing or acquiring the products or services that your company sells.

Expenses

Expenses are simply the costs that you incur in order to operate and maintain your business on a daily basis. Examples include rent, utilities, salaries and wages, supplies, or advertising costs.

Other Income

Other income is simply money that your company has earned from sources outside of your primary business operations. Examples include interest paid from a business savings account, investment earnings, or proceeds from insurance.

Net Income - How Much You Made

Net income - this is the exciting one. It’s the key financial metric to understand and optimize for - because it’s the amount of income you made after subtracting all expenses and taxes from your company’s total revenue. More simply, it’s the amount of money that your company has earned, or lost, after accounting for all of your costs.

8 simple steps to building your Income Statement

To create your Income Statement, first download the free, customizable template. Next, fill in all of your financial data. We’ve included al of the most pertinent information you need to track in our free downloadable Income Statement template.

Want a quick and streamlined lesson? Follow the instructions below to create your simple and professional Income Statement from beginning to end.

1. Download the template

Download any of our free Income Statement templates from the top of this web page. No matter what format you need, we’ve got you covered.

2. Input your info

Input your company’s name. This will help to keep your documents organized and is helpful for your accountant when you decide to hire one.

3. Add your revenue

The first step is to include all of your revenue from this period.

4. Include the time period

It’s important to include the time period that your Income Statement covers. This is typically for a year or a quarter.

5. Add your cost of goods sold

This helps you track the direct costs associated with producing or acquiring the products or services your business sells

6. Add your expenses

Expenses are the costs you incur in order to operate and maintain your business.

7. Add other income

Don’t forget to include your other income sources. This is simply the money your business has earned from sources outside your main business operations.

8. Look at your total

Examine your Net Income! Your Net Income is calculated by subtracting your cost of goods sold, expenses, and taxes from your total income.

Sick of manually creating Income Statements? Check out TrulySmall Accounting!

TrulySmall Accounting is the easiest accounting app for small businesses. Just connect your bank account and we’ll categorize all of your transactions for you and you’ll get all of your financial statements populated in 5 minutes or less.

Save time and get peace of mind. Start automating with TrulySmall Accounting!

Why are financial statements important for small business owners?

Gain Business Insights

Financial statements will give you a deeper understanding of how your business is doing at a given point in time. They are a crucial tool when it comes to analyzing, monitoring, and understanding your businesses financial health

File Taxes Easily

Maintaining detailed financial reporting throughout the entire year will help you tremendously when it comes to tax time! Stress-less and get through your tax-filing quicker.

Get a loan

Financial statements are the documents that your bank will ask for when you’re ready to apply for a loan! Have them prepared early on so you can quickly show the health of your business over time.

I don’t want to use an Income Statement template—how does Truly Small Accounting help my business?

Our free Income Statement template is great for small businesses who want a free way to track their financial data. But if you’re looking for an even quicker way to populate your financial statements, TrulySmall Accounting is the answer!

TrulySmall Accounting helps to automate your entire accounting and bookkeeping process. All you have to do is connect your bank account and we’ll do the rest of the work for you! Not only will your financial statements be ready for you in 5 minutes or less, you’ll also have a visual dashboard filled with business insights waiting for you.

Piqued your interest?

Try out Truly Small Accounting today to find out how our software can automate your accounting and bookkeeping process.