Money In & Out Budget Template<span data-metadata="">

We get it. As a small business owner, you just want to know how quickly your money is coming and going.

This budget template will help you see exactly what’s going on with your cash flows, so that you can focus on the jobs that really matter. And be sure to check out the rest of our customizable budgeting templates above!

Download as:

<span data-metadata=""><span data-buffer="">Today’s Entrepreneurial Workforce

The independent workforce is growing, and busier than ever. But a lot of them don’t have the background or training to learn the backend of running a successful business: namely when it comes to managing accounting and finances.

These budgeting templates will help you build an organized budget for your next project – so that you can keep your cash flowing!

What should I include in my budget?

New to budgeting? Here’s what to include on your budget template to keep track of your finances! Your Money In & Out budget should include everything that has come into, and left, your bank account over the time period of your choice. At a minimum, here’s what should be included:

Project/Job description

A brief description of the project or job that the budget relates to.

Client Info

Add any pertinent info that you would like to include relating to your client, where the job is located, or a slightly more detailed description of the project.

Professional Info

Include your professional information to make sure that your client can reach out to you if they have any questions, as well as a broad estimate of how long the project will take you.

Category/Item Info

Include detailed descriptions of every item, tool, material, or cost that you think will go into the project.

Cost Info

This is the important part - be sure to include detailed cost information for every line item that you’ve listed under the ‘Category & Items’ section.

Payment Info

Include any information about items that have been pre-paid for, or items that have recently become payable or due.

Project Specific Info

Adding project specific info will help you build trustworthy client relationships - and also let you know who is responsible for individual tasks in the event of more complex projects.

Progress bars for each line items

Progress bars will help you indicate exactly where each item stands at any given point in time - simply click the drop down tab and choose from a range of options!

8 simple steps to building your template

First, download our free, customizable template. Next, fill in all your details. Be sure to categorize your

Want a quick and streamlined lesson? Follow the instructions below to create your Money In & Out budget from beginning to end.

<span data-metadata=""><span data-buffer="">1. Download the template

Download our free Money In & Out Budget from the top of this page!

<span data-metadata=""><span data-buffer="">2. Input your info

Always include your business name and any contact info when building budgets!

<span data-metadata=""><span data-buffer="">3. Include a date range

It’s essential to include the date range of the period you are budgeting for!

4. Add your Money In<span data-metadata="">

This is where you log every dollar that is coming in to your business!

5. Add your Money Out

This is where you log every dollar that is leaving your business.

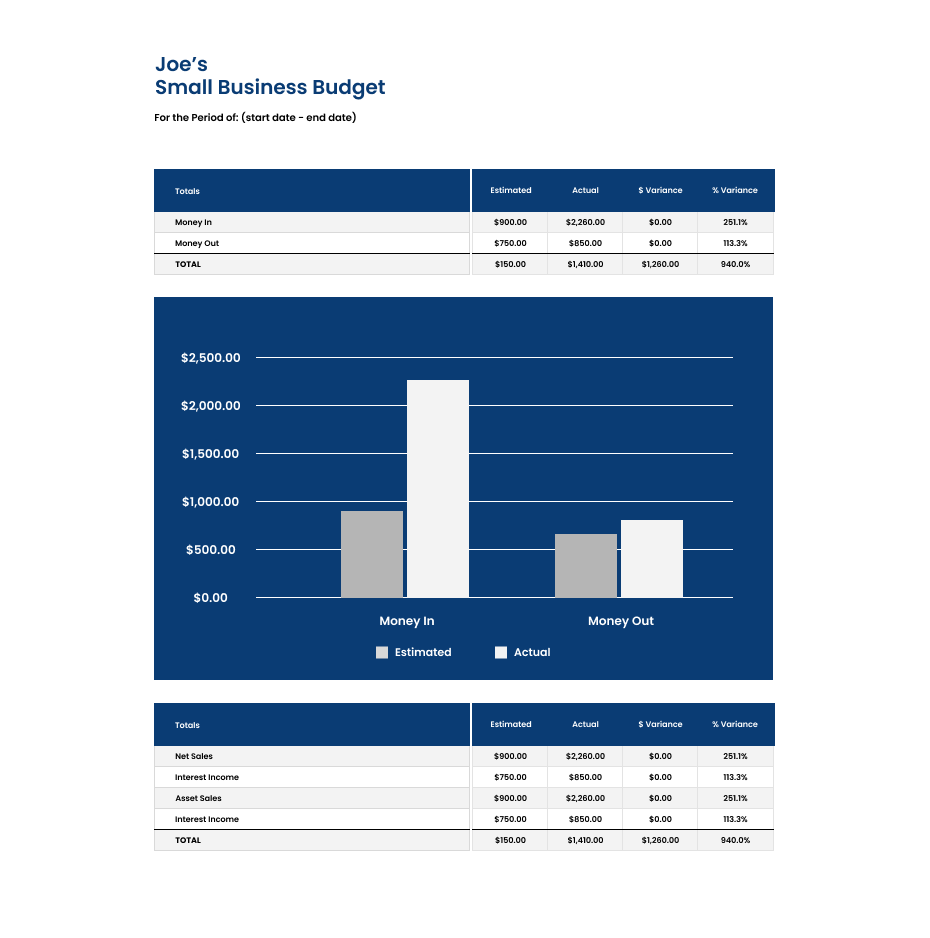

6. See how you're doing on the left

The chart in the budget will automatically populate once you fill in your data!

7. Check out your totals!

The totals for each column will automatically appear once you fill in your data!

Sick of manually tracking budgets? Check out TrulySmall Expenses!

TrulySmall Expenses is the easiest expense tracking nd budgeting app for small businesses. Create a budget and we’ll keep an eye on your spending. Set spending limits and we’ll let you know when you’re getting close.

You can even connect your bank account so you no longer have to manually enter your spending transactions to update your budget.

Why is budgeting important for small business owners?

Keep track of spending

As a small business owner, it’s important you keep an eye on your spending to make sure you’re not spending more than you can afford.

Better client estimates

Budgets allow you to break down all of your spending categories which means you can get a clearer look at how much you should be charging your clients.

Understand your biz

Budgeting is also a great way to learn more about your business. Figure out where you can cut costs and where to spend more, how your projects went, and which services are the most costly!

I don’t want to manually track my budget—how does Truly Small Expenses help my business?

TrulySmall Expenses is the perfect tool to help automate your budgeting and expense tracking. When you connect your bank account, we’ll automatically import all of your transactions so you don’t have to worry about calculating your spending on your own.

TrulySmall Expenses also has reporting built in so you can easily see your spending trends and more in just a glance.

Piqued your interest?

Try out TrulySmall Expenses today to find out how our software can automate your budgeting process.