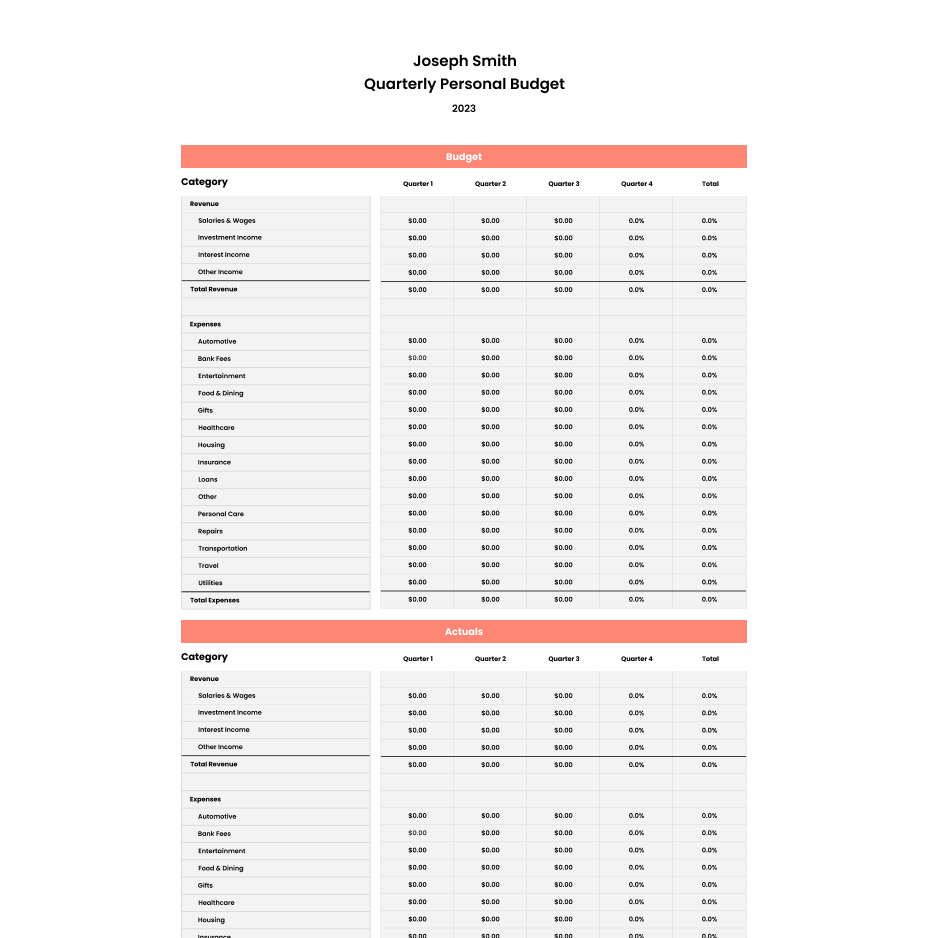

Free Personal Quarterly Budget Template

We get it. Budgeting is not something that was taught in school, and budgeting for your personal life can be a hard habit to build!

Thank goodness TrulySmall™ offers a range of customizable budgeting templates for you to quickly keep track of all your finances.

Download as:

What should I include in my personal budget?

New to budgeting for your personal finances? Here’s what to include on your budget template to keep track of your finances! Your budget should include all sources of income as well as every category of expense! At a minimum, here’s what to include in your personal quarterly budget.

Project/Job description

A brief description of the project or job that the budget relates to.

Client Info

Add any pertinent info that you would like to include relating to your client, where the job is located, or a slightly more detailed description of the project.

Professional Info

Include your professional information to make sure that your client can reach out to you if they have any questions, as well as a broad estimate of how long the project will take you.

Category/Item Info

Include detailed descriptions of every item, tool, material, or cost that you think will go into the project.

Cost Info

This is the important part - be sure to include detailed cost information for every line item that you’ve listed under the ‘Category & Items’ section.

Payment Info

Include any information about items that have been pre-paid for, or items that have recently become payable or due.

Project Specific Info

Adding project specific info will help you build trustworthy client relationships - and also let you know who is responsible for individual tasks in the event of more complex projects.

Progress bars for each line items

Progress bars will help you indicate exactly where each item stands at any given point in time - simply click the drop down tab and choose from a range of options!

6 simple steps to building your personal quarterly budget

To create your personal budget template, first download the free, customizable template. Next, fill in all the details. Different people will have different income + expense categories.

Want a quick and streamlined lesson? Follow the instructions below to create your personal budget from beginning to end.

<span data-metadata=""><span data-buffer="">1. Download the template

Download any of our free personal budget templates from the top of this web page. No matter what format you need, we’ve got you covered.

<span data-metadata=""><span data-buffer="">2. Input your info

Input your info into the downloaded budget.

<span data-metadata=""><span data-buffer="">3. Add your budget name

<span data-metadata=""><span data-buffer="">4. Add your income sources

Include all of your income sources to see how much you’ve made throughout the year.

<span data-metadata=""><span data-buffer="">5. Add your expenses

6. View your totals

<span data-metadata=""><span data-buffer="">Sick of manually tracking budgets? Check out TrulySmall Expenses!

TrulySmall Expenses is the easiest expense tracking nd budgeting app! Create a budget and we’ll keep an eye on your spending. Set spending limits and we’ll let you know when you’re getting close.

You can even connect your bank account so you no longer have to manually enter your spending transactions to update your budget.

Why do I need to budget?

Keep track of spending

Budgeting helps you keep an eye on your spending. When you set a target for each expense category in your life, it becomes easier to to make sure you’ve got enough money for what’s important.

Save for long term goals

Once you start tracking all your expenses, you’ll have a clearer idea of how much money you have left to save towards bigger goals. Want to start saving more? See where you can cut down on your spending!

Build better habits

Having clarity in your spending is a crucial part to building better financial habits. Soon you’ll be able to manage your spending AND save effortlessly.

I don’t want to manually track my budget—how does Truly Small Expenses help.

TrulySmall Expenses is the perfect tool to help automate your budgeting and expense tracking. When you connect your bank account, we’ll automatically import all of your transactions so you don’t have to worry about calculating your spending on your own.

TrulySmall Expenses also has reporting built in so you can easily see your spending trends and more in just a glance.

Piqued your interest?

Try out TrulySmall Expenses today to find out how our software can automate your budgeting process.