Today’s Entrepreneurial Workforce

The independent workforce is constantly growing. Contractors are also providing more add-on services as they go based on client needs. As a result, there just isn’t enough time for construction and trades professionals to learn the backend of running a successful business: namely, the accounting and finances.

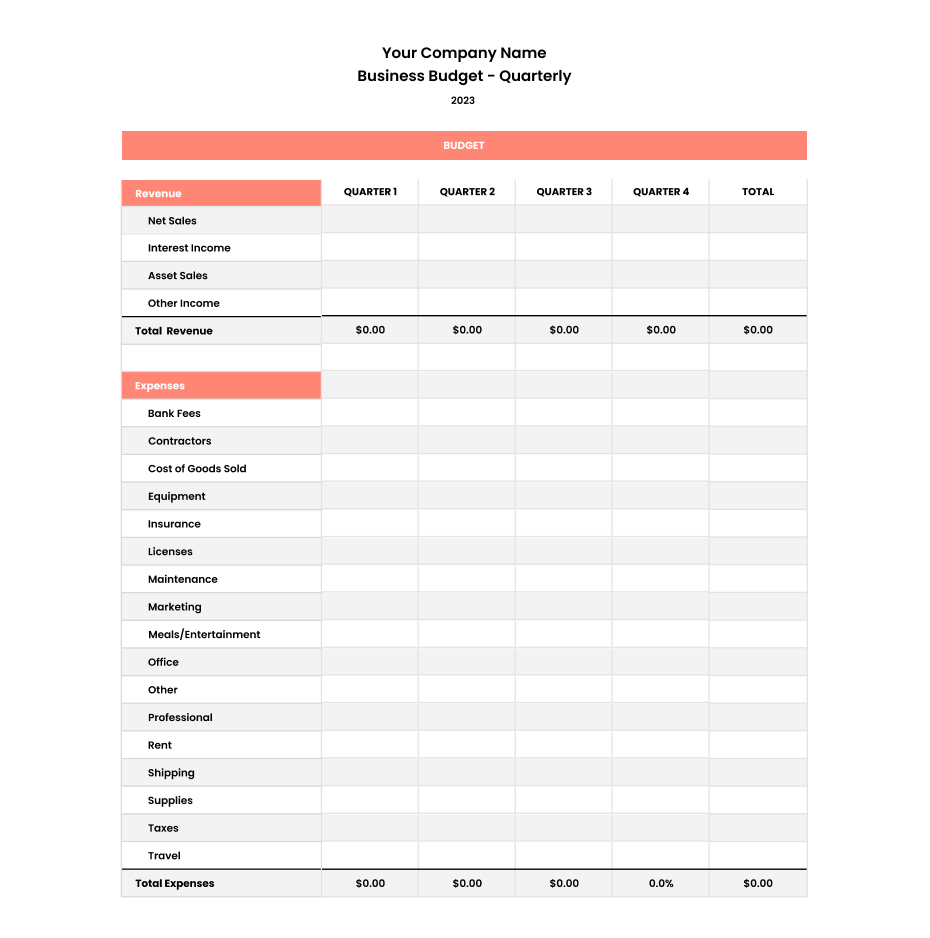

These budgeting templates will help guide you to budget for your next project in a professional manner—so that you can keep your cash flowing.

Sick of manually tracking budgets? Check out TrulySmall Expenses!

TrulySmall Expenses is the easiest expense tracking nd budgeting app for small businesses. Create a budget and we’ll keep an eye on your spending. Set spending limits and we’ll let you know when you’re getting close.

You can even connect your bank account so you no longer have to manually enter your spending transactions to update your budget.

Why is budgeting important for contractors?

Keep track of spending

Better client estimates<span data-buffer="">

Budgets allow you to break down all of your spending categories which means you can get a clearer look at how much you should be charging your clients.

Understand your biz<span data-buffer="">

Budgeting is also a great way to learn more about your business. Figure out where you can cut costs and where to spend more, how your projects went, and which services are the most costly!

I don’t want to manually track my budget—how does Truly Small Expenses help my business?

TrulySmall Expenses is the perfect tool to help automate your budgeting and expense tracking. When you connect your bank account, we’ll automatically import all of your transactions so you don’t have to worry about calculating your spending on your own.

TrulySmall Expenses also has reporting built in so you can easily see your spending trends and more in just a glance.